You can now use your health savings account to purchase period products

Big news: On March 27, 2020, U.S. lawmakers passed a $2 trillion stimulus package, the Coronavirus Aid, Relief, and Economic Securities (CARES) Act, which now classifies menstrual care products as qualified medical expenses.

This means that individuals with a health savings account (HSA), flexible spending account (FSA), or certain health reimbursement arrangements (HRA) can use these accounts – which use pretax dollars taken from workers’ paychecks – to purchase menstrual products. The Act also looped over-the-counter drugs into the eligible mix of products for HSA or FSA spending.

Prior to this legislation, only a limited range of healthcare-related expenses could be paid for with an HSA or FSA, including “the costs of diagnosis, cure, mitigation, treatment, or prevention of disease.” With the expansion of the ACA under the Obama administration, over-the-counter medications were added to the list – but only if you had a prescription for them. Now, you can pay for or be reimbursed for OTC drugs with your HSA/FSA without a prescription.

Click here to read the legislation in full.

What exactly does this mean for menstruators? HSA, FSA menstrual products:

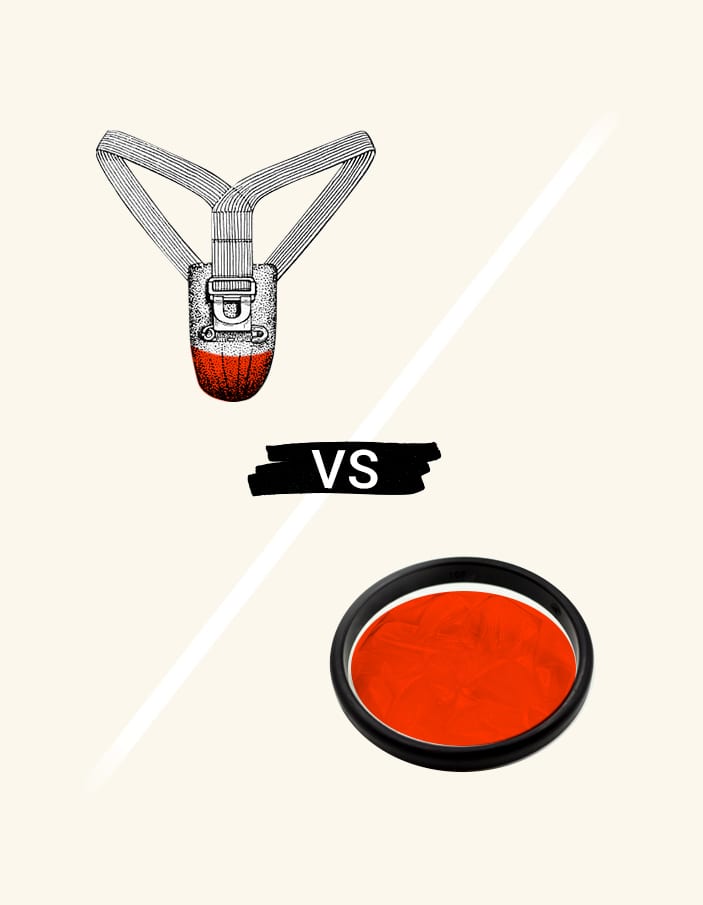

Sec. 3702 of the CARES Act states: “amounts paid for menstrual care products shall be treated as paid for medical care.” The rule defines a “menstrual care product” as “a tampon, pad, liner, cup, sponge, or similar product used by individuals with respect to menstruation or other genital-tract secretions.” Yes, this includes Flex Disc™ and Flex Cup™, which are also eco-friendly options to manage your menstrual flow.

You’re probably wondering, “are tampons FSA eligible?” or “are pads FSA eligible”? For those out wondering what exactly is included, here’s the full list of FSA/HSA menstrual products: 1

- Cups*

- Liners

- Sanitary Pads, including both non-disposable and disposable pads

- Tampons

- Disposable and non-disposable underwear for menstruation

- Sponge

* According to the Special Interest Group for IIAS Standards (SIGIS), which designates HSA- and FSA-eligible products for the IRS, both Flex Disc and Flex Cup are classified as menstrual cups.

If you have HSA or FSA dollars remaining, you’ll also be able to file for reimbursement of any menstrual products you purchased in 2020, so start gathering those receipts. If you typically purchase menstrual products at a drugstore like CVS or Walgreens and you have a store card, you may be able to look up your receipts online by logging into your account.

The CARES Act also allows for the purchase of OTC drugs and medicines without a doctor’s prescription. This means you can also use your HSA/FSA funds to purchase pain relievers, like Midol, Advil, or Aleve, for management of PMS symptoms (or any other reason). For the full list of eligible items and medications covered, refer to this page on the SIGIS website.

After years of period care products being taxed as “luxury” items and being denied classification as medical expenses, the passing of this legislation is a big deal for all who menstruate.

When can I start using my FSA/HSA dollars to purchase menstrual products?

Even though the CARES Act was officially signed into law in March, it may take benefits administrators some time to apply the changes to their policies. The best way to find out the answer to that question is to contact your benefits administrator.

Keep in mind that the Act will apply retroactively beginning January 1, 2020, so save your receipts for eventual reimbursement. If you buy (or have previously bought) products from Flex®, feel free to send us an email at hello@flexfits.com to request a receipt.

Those with FSAs should remember to check their deadline to submit reimbursements for the 2020 calendar year (more on this below). There is no reimbursement deadline for HSA holders, however.

I have an FSA – what’s the deadline to submit expenses for reimbursement?

A large majority of FSA holders have reimbursement deadlines that fall on the end of the calendar year – i.e. December 31st, 2020. However, this doesn’t apply to all FSAs. Make sure to contact your FSA administrator so that you’re totally clear on your deadline, processes, and options.

If you do have the 12/31 deadline, it’s usually pretty strict, but you may be entitled to a grace period or runout period. Talk to your administrator to learn more.

Is this a temporary change?

Although the CARES Act was passed in response to the current coronavirus pandemic, rules classifying period products as “medical expenses” were approved into law and are likely permanent. However, the CARES Act does not specify whether or not menstrual products will remain protected in future tax law after the COVID-19 pandemic is over.

Does this mean I don’t have to pay tax on period products?

The CARES Act does not affect sales tax on period products (a.k.a. the “pink tax”), but it allows for the use of tax-free income to purchase period products if you have access to FSA or HSA funds.

Keep in mind that not all employers offer FSA, HSA, or HRAs, and these accounts are typically unavailable to those who are unemployed. However, in some cases, you may be eligible for an HSA if you are self-employed or hold another title besides “employee.” This depends on your specific health insurance coverage.2

What if my employer doesn’t offer an HSA, FSA, or HRA?

Unfortunately, you must have access to a funded HSA, FSA, or (certain types of) HRA in order to take advantage of using tax-free money for the purchase of period products.

© 2021 The Flex Company. All Rights Reserved.