FSA vs. HSA: Everything you need to know

Acronyms! The world is full of them. From IRL to the CDC and more, our brains have to process what feels like an acronym a minute, and we’re not always sure WTF they mean.

If you’ve recently seen period product companies praising the Cares Act, it’s because of a section of the recent stimulus package that allows menstrual products to be treated as medical care and therefore eligible for reimbursement through FSA and HSA programs.

What is an HSA?

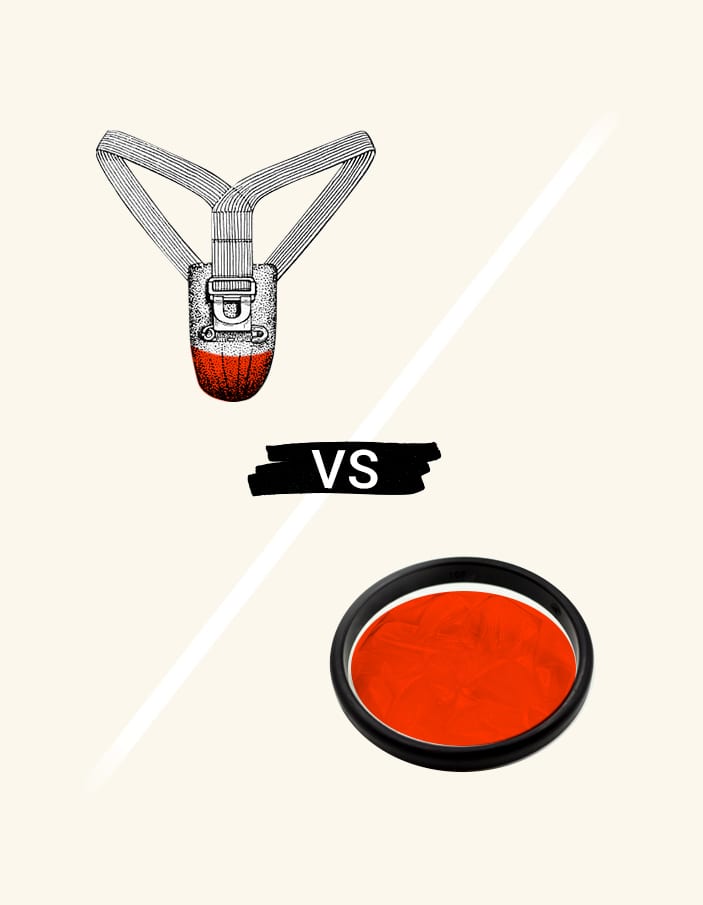

An HSA, or a “Health Savings Account” is a funding account offered in conjunction with a high deductible insurance policy. Sort of like a personal savings account, you get to determine a monetary amount (pre-taxed!) to put in each month (or annually) that you can use to pay for qualifying medical expenses.

The range of what this can cover goes from out-of-pocket medical costs at the doctor to menstrual cups and discs.

What is an FSA?

FSA stands for “Flexible Spending Account or Arrangement”. It’s very similar in nature to an HSA but has some key differences. While an HSA can be opened by employed and self-employed individuals, an FSA can only be opened by employees (i.e. you cannot be self-employed).

Unlike an HSA, an FSA is owned by your employer, and to receive a reimbursement you usually have to submit a claim along with a receipt to your employer and get approval.

Additionally, there are differing maximums on the amount of money you can contribute to an HSA vs an FSA, and money in an HSA will carry over into the next year while an FSA will not. So use it or lose it!

What do they cover?

Regardless of if you have an HSA or an FSA, the IRS covers the following:

- Copays or deductibles

- Qualifying prescriptions

- Certain medical equipment

- Period products!

For a more in-depth list, head here.

What does this have to do with menstruation?

As we mentioned up top, the new Cares Act allows for people to spend their FSA or HSA contributions on period care or products. This applies to menstrual discs, tampons, pads, menstrual cups, and so much more.

This is exciting because period products have often been seen as a “luxury” item, which makes it challenging for those who have different socioeconomic backgrounds to access quality period care.

With this new classification, there is more equality within the period care access space, and this allows for menstruators to get the products they need at a more affordable cost via income tax savings.

10 unexpected things you can buy with your FSA + HSA

Aaaaand just like all the other new tricks you’re learning in quarantine (hello professional sourdough bread baker), here are 10 things you can snag with that FSA or HSA cash.

- Skincare. A visit to the derm and acne treatment? Check.

- Heating pads. Cramps can take a chill pill, because the HSA and FSA got your back.

- Sunscreen. All your SPF needs are covered…literally.

- Vitamins. D, E, C, A. All the letters of the vitamin alphabet are a GO.

- Condoms. Protection is protected.

- Pregnancy tests. Keep yourself in the know, bb.

- Bandages. Need to get a quick leg wrap after a fall during a midday run? You’re all set.

- Eye masks. Getting your beauty rest, thanks to some help from your FSA/HSA.

- Sunglasses. Throw some shade…on.

- Light therapy. Keep your face feeling warm and glow-y. UV lights get the green light.

This article is informational only and is not offered as medical advice, nor does it substitute for a consultation with your physician. If you have any gynecological/medical concerns or conditions, please consult your physician.

© 2021 The Flex Company. All Rights Reserved.